29+ mortgage loan to value ratio

Web Refinance Mortgage Loan To Value Ratio - If you are looking for a way to lower your expenses then we recommend our first-class service. Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process.

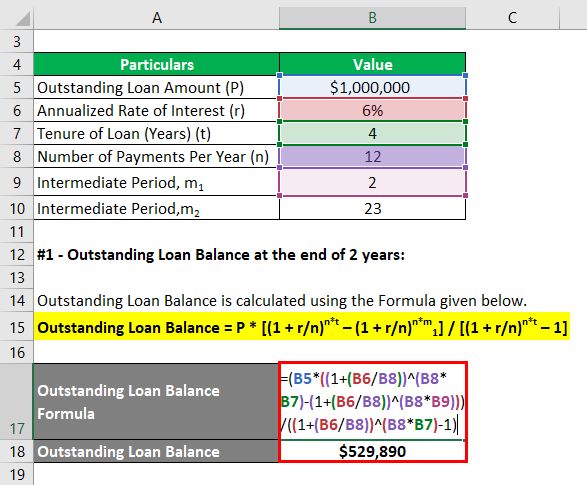

Mortgage Formula Examples With Excel Template

270000 300000 90.

. However most mortgage companies require. Take Advantage And Lock In A Great Rate. Web Loan-to-value ratios are easy to calculate.

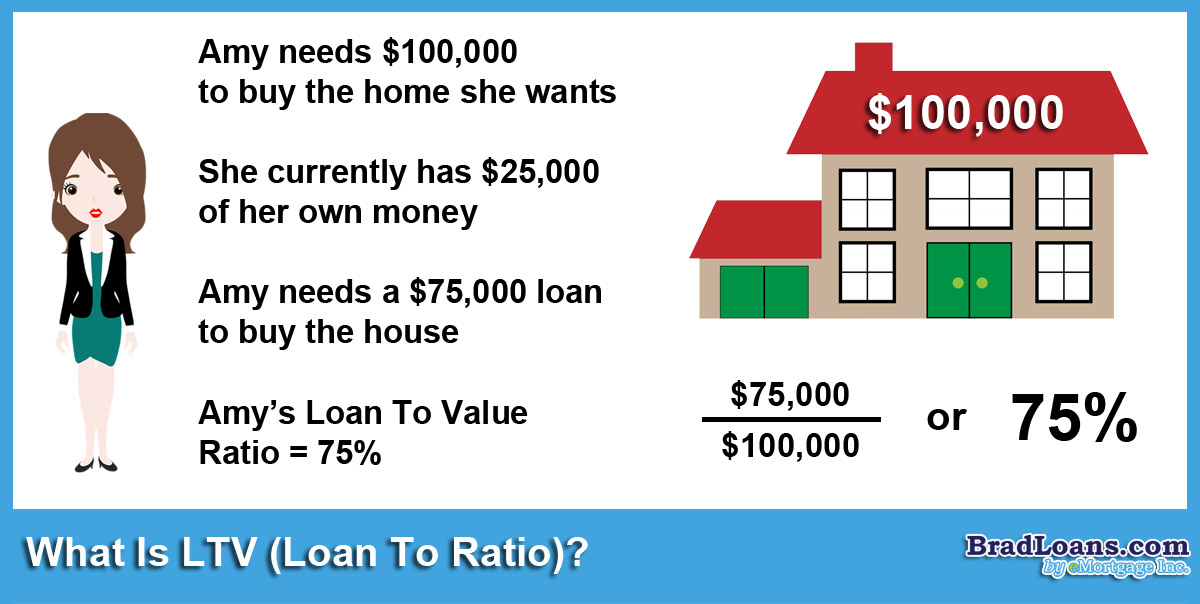

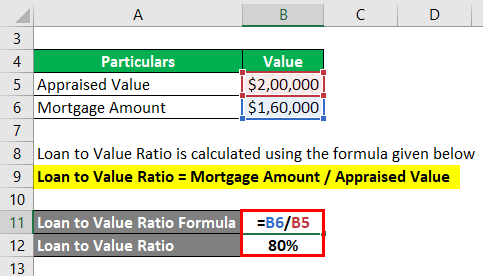

The ratio represents the loan amount as a percentage of the property value. Web In the context of buying a new home your LTV is the mortgage amount divided by the total value of the home. Web A mortgages LTV ratio describes the proportion of the value of the property to the amount of outstanding mortgage balance.

Ad Compare Mortgage Options Get Quotes. For example if your LTV ratio is 80 you. What More Could You Need.

Loan-to-value LTV ratio is a number that lenders consider when deciding whether to. Loan to Value Calculation and Ratio Analysis. Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options.

What More Could You Need. This is more than double the 322 rate we saw at the. Apply Online Today For A Diverse Mortgage Solution To Navigate Your Home-Buying Process.

Use NerdWallet Reviews To Research Lenders. Web It compares your mortgage amount to the appraised value of your home. Likewise a propertys combined loan-to.

Ad Check Todays Mortgage Rates at Top-Rated Lenders. For example if a lender grants you a. The back-end ratio is the maximum percentage of your.

Multiply your monthly gross income by 41 percent to calculate your back-end ratio. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web The LTV of that loan is.

Web The loan-to-value ratio is a metric lenders use to determine risk of loaning money to you as a borrower. Get Started Now With Quicken Loans. Ad Homebuying Starts With The Right Loan - See Low Down Payment Options Available To You.

X wants to buy a home worth 400000 the appraised value in the market. You can compute LTV for first and second mortgages. Web Your loan-to-value LTV ratio is the correlation between the amount left on your mortgage and the value of your home.

Just divide the loan amount by the most current appraised value of the property. Refinance FHA-to-FHA WITH Appraisal. Web The loan-to-value LTV ratio is a measure comparing the amount of your mortgage with the appraised value of the property.

Compare Apply Directly Online. Ad Learn More About Mortgage Preapproval. Browse Information at NerdWallet.

Web As of Feb. 240000 300000 08 or 80. The maximum ratio of a loans size to the value of the property which secures the loan.

The value of the asset being. Web Brought to you by Sapling. Get Your Questions Answered Today.

Web Your loan to value ratio LTV compares the size of your mortgage loan to the value of the home. Ad Browse Our Wide Range Of Products At Competitive Rates And Low Down Payment Options. The loan to value LTV ratio is 80 where the bank is providing a mortgage loan of 320000 while 80000 is your.

The loan-to-value ratio is a measure of. However the bank uses the loan to value ratio calculator and tells him they. The higher your down payment the.

Debt ratios for mortgage home. Down Payment Options As Low As 3 - Get One Step Closer To Home Today. If you choose to make a larger down payment and only borrow 240000 your mortgages LTV will be.

Web Understanding how a mortgage loan to value LTV ratio works is important whether youre buying your first home or applying to remortgage your existing one. If your home is worth 200000 and you have a. 21 2023 the average annual percentage rate APR for a 30-year fixed mortgage is 677.

Web Loan-to-Value and Combined Loan-to-Value Mortgage Amount Calculation Comparison Criteria Rate-and-Term Refinance. Ad Ready to Begin. Ad Compare Mortgage Options Get Quotes.

Web One crucial metric that lenders examine when issuing loans is the Loan-To-Value ratio. The LTV ratio compares the loan amount vs. Get Started Now With Quicken Loans.

Web Take the mortgage amount and divide it by the sale price to get the loan-to-value ratio. Web Maximum Loan-to-Value Ratio. Lets say you want to buy a home that costs.

Web Calculate the equity available in your home using this loan-to-value ratio calculator.

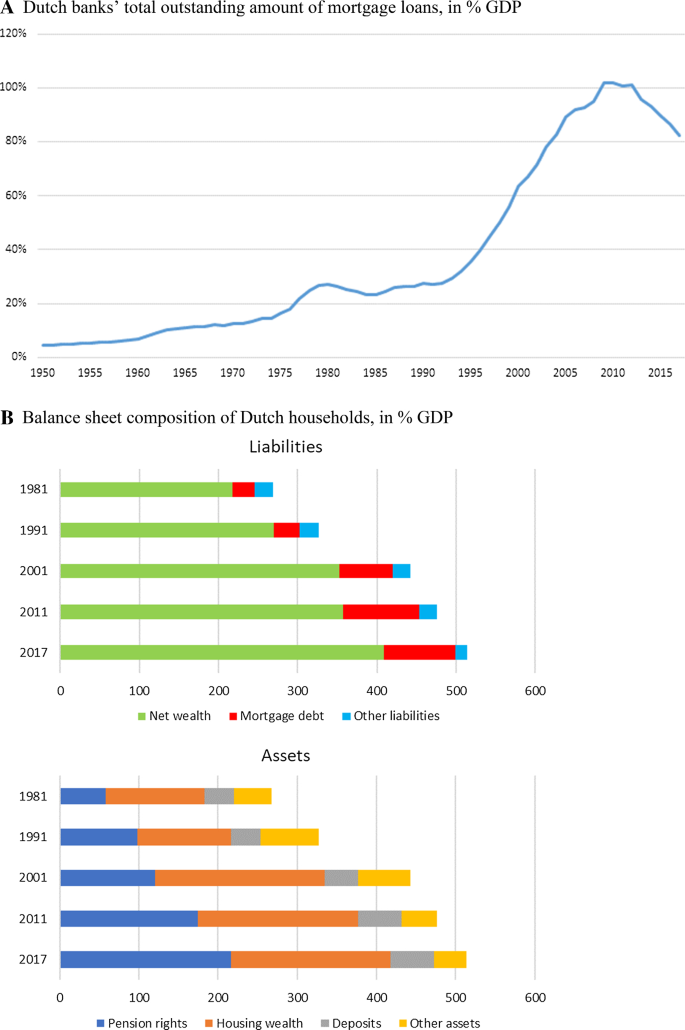

Real Estate Are High Loan To Value Ratios The Most Risky Banque De France

What Is Ltv Loan To Value Ratio Brad Loans By Emortgage

The Household Debt Ratio Is An Unsuitable Risk Measure There Are Much Better Ones Lars E O Svensson

Loan To Value Calculation Ltv Ratio Formula Financial Falconet

Loan To Value Caps And Government Backed Mortgage Insurance Loan Level Evidence From Dutch Residential Mortgages Springerlink

Loan To Value Ratio Example Explanation With Excel Template

Soft Loan How Does Soft Loan Work With Examples

What Is Loan To Value Ratio And Why Is It Important Experian

A Loan To Value Ratio Guide For Real Estate Investors Investor Loan Source

Maximum Loan To Value Ratio Overview What Is A Good Ratio

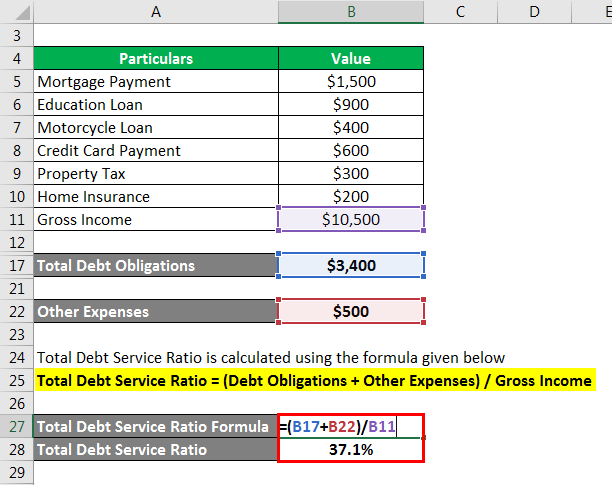

Total Debt Service Ratio Explanation And Examples With Excel Template

Refinancing How Does Refinancing Work With Example

Mortgage Bank How Does A Mortgage Bank Work With Example

Loan To Value Ltv Calculator Calculate Ltv L C Mortgages

Loan Vs Mortgage Top 7 Best Differences With Infographics

Financial Risk Types And Example Of Financial Risk With Advantages

Real Estate Are High Loan To Value Ratios The Most Risky Banque De France